Expression Merchandise

Go for country specific collection from above country specific menu for Free shipping !

Featured products

-

Serpent in me - Women's Long Sleeve V-neck Shirt (AOP)(USA)

Regular price $37.95 USDRegular priceUnit price / per$43.21 USDSale price $37.95 USDSale -

Ringneck Tumbler, 20oz- Teddy B (USA)

Regular price $24.64 USDRegular priceUnit price / per$30.32 USDSale price $24.64 USDSale -

Japanese Minka Matte Canvas, Black Frame (USA)

Regular price $53.24 USDRegular priceUnit price / per$55.84 USDSale price $53.24 USDSale -

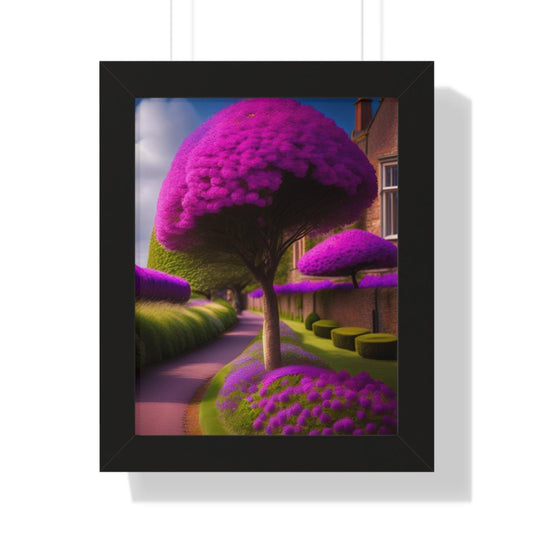

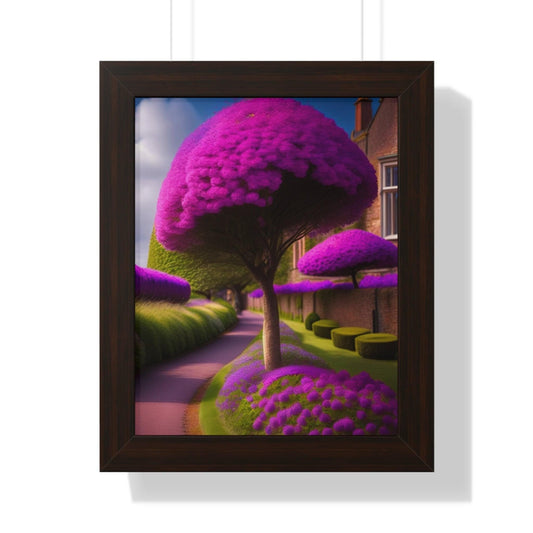

Framed Vertical Poster -Lavender - (USA)

Regular price $48.25 USDRegular priceUnit price / per$52.53 USDSale price $48.25 USDSale -

12 Oz- Scenic Green tone - Enamel Camping Mug (USA)

Regular price $20.81 USDRegular priceUnit price / per$24.57 USDSale price $20.81 USDSale -

Road into the village -Framed Vertical Poster (USA)

Regular price $44.06 USDRegular priceUnit price / per$51.69 USDSale price $44.06 USDSale -

Blue Dream Yak - Satin Poster (USA)

Regular price $26.26 USDRegular priceUnit price / per$30.50 USDSale price $26.26 USDSale -

Black Mug, 15oz - Serpent from Deep Sea womb (USA)

Regular price $17.79 USDRegular priceUnit price / per$22.03 USDSale price $17.79 USDSale